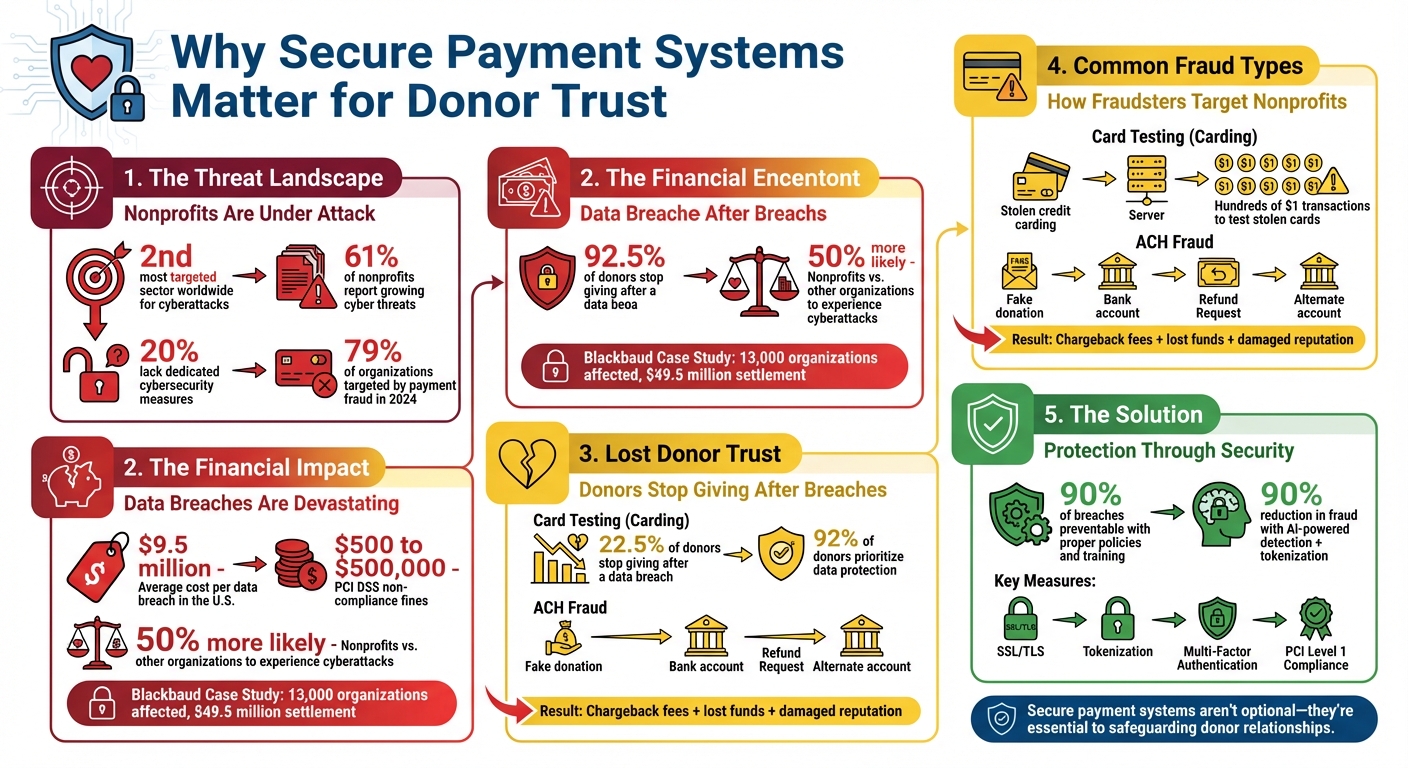

Why Secure Payment Systems Matter for Donor Trust

Secure payment systems protect donors and fundraising by preventing breaches, fraud and chargebacks using encryption, tokenization, MFA, and PCI compliance.

When donors give, they expect their personal and financial information to be secure. A failure to meet this expectation can result in lost donations, damaged reputations, and significant financial losses. Here’s why secure payment systems are critical for nonprofits:

- Data breaches are costly: Nonprofits lose an average of $9.5 million per breach in the U.S. alone.

- Donor confidence is fragile: 22.5% of donors stop giving after a data breach.

- Cyber threats are rising: 61% of nonprofits report growing threats, but 20% lack dedicated cybersecurity measures.

- Fraud is a major issue: Scams like card testing and ACH fraud lead to financial losses and chargeback fees.

To protect donor trust, nonprofits must implement robust security measures such as encryption, tokenization, and multi-factor authentication. Partnering with platforms like HelpYouSponsor can offload compliance requirements while ensuring payment systems are secure, transparent, and efficient.

Bottom line: Secure payment systems aren’t optional - they’re essential to safeguarding donor relationships and maintaining fundraising success.

The Cost of Insecure Payment Systems for Nonprofits

Bonus Episode: Mastering Payment Processing: Essentials for Safe Online Giving

The Risks of Insecure Payment Systems

Failing to secure your payment systems can leave your nonprofit vulnerable to serious threats. Cybercriminals are increasingly targeting nonprofits, making them the second-most targeted sector worldwide. Many organizations focus on simplifying the donation process but often neglect the critical need for strong security measures. With limited resources to combat sophisticated attacks, nonprofits are left open to risks that can erode donor trust and jeopardize their operations.

Data Breaches and Lost Donor Confidence

A data breach isn't just about stolen credit card numbers - it can expose sensitive information like Social Security numbers, bank account details, and login credentials that donors trust you to safeguard. A glaring example is the Blackbaud ransomware attack in May 2020. This breach, caused by inadequate security measures, impacted 13,000 nonprofits, universities, and hospitals. The fallout was significant: in October 2023, Blackbaud agreed to a $49.5 million settlement with 49 states and Washington, D.C..

California Attorney General Rob Bonta emphasized: "Not only did Blackbaud fail to protect consumers' personal information, but they misled the public of the full impact of the data breach. This is simply unacceptable. Today's settlement will ensure that Blackbaud prioritizes safeguarding consumers' personal information and enhances security measures to prevent future incidents."

The consequences of such breaches are immediate and far-reaching. Research reveals that 22.5% of donors would stop giving to a charity if it experienced a data breach. Losing donor confidence not only disrupts current fundraising efforts but can take years to rebuild. Beyond breaches, fraudulent activities pose additional threats to both your finances and reputation.

Fraud and Financial Losses

Donation forms used by nonprofits are frequent targets for credit card fraud. A common tactic, known as "carding," exploits the simplicity of these forms compared to retail systems. Fraudsters use stolen credit card details to run hundreds of small transactions - often just $1 each - to identify active cards, which they later use for larger fraudulent purchases.

The financial impact goes beyond the stolen funds. Nonprofits often face chargeback fees when fraudulent transactions are flagged, and failing to comply with PCI DSS standards can result in fines ranging from $500 to $500,000. Add to this the costs of forensic investigations, insurance claims, and the staff time diverted to address these issues, and the strain on resources becomes overwhelming.

Another common scam involves ACH fraud, where scammers use stolen routing numbers to make large "donations" and later request refunds to alternate accounts. When banks reverse these unauthorized transactions, nonprofits not only lose the initial donation but also end up refunding the scammers, effectively doubling the financial hit. These kinds of losses directly undermine donor trust, making the overall security threat even more damaging.

Unclear Payment Processes

Redirecting donors to unfamiliar or unbranded third-party sites can be a major red flag. When donors perceive a transaction as risky, they’re likely to abandon the process entirely.

As WildApricot explains: "Safety is truly the number one concern of donors! While a funky donate page might turn off some of your donors, risky security features will stop ALL donations in their tracks".

In addition to security concerns, a lack of transparency in payment processes can further alienate donors. If donors don’t receive automated receipts or clear confirmation of their transaction, they may question whether their gift was successfully processed. Uncertainty about costs or the status of their donation can erode trust and discourage future contributions.

Security Features That Protect Donor Transactions

Protecting donor transactions is essential for maintaining trust and preserving your organization's reputation. Here’s how robust security measures can ensure safe and secure contributions.

Encryption (SSL/TLS) is the backbone of secure online transactions. By encrypting sensitive information like credit card numbers, it ensures that data remains unreadable while in transit. To meet PCI DSS requirements, make sure your entire website operates over HTTPS.

Tokenization adds another layer of security by replacing actual credit card numbers with unique tokens - random strings of characters that hold no value outside your system. This method allows you to process recurring donations without storing sensitive card details on your servers. Even if hackers breach your system, they’ll only find these meaningless tokens, minimizing the risk of data theft. For example, incorporating tokenization alongside AI-powered fraud detection can cut down fraudulent carding attempts by up to 90%.

Multi-factor authentication (MFA) is a must for staff accounts with access to donor databases or payment systems. MFA requires two or more verification steps, such as a password and a code sent to a mobile device, making unauthorized access significantly harder. Similarly, advanced fraud detection systems use AI and machine learning to monitor transactions in real time. These systems can flag suspicious activities, like multiple rapid donations from the same IP address, which may signal card-testing attacks. Together, these measures create a secure payment environment, reinforcing donor confidence.

Finally, ensure your payment processor meets PCI DSS compliance - preferably at Level 1 certification. This level of compliance shifts most of the security burden to the processor, reducing your organization’s exposure to risk. Avoid storing unnecessary data, like CVV codes or full card numbers, to further minimize potential vulnerabilities.

How HelpYouSponsor Ensures Secure Payment Handling

HelpYouSponsor prioritizes secure payment handling to strengthen donor trust and protect sensitive information. By managing the technical complexities of payment security, the platform allows nonprofits to focus on their mission. HelpYouSponsor collaborates with PCI Level 1 Service Providers, the highest certification level in the payments industry, ensuring organizations benefit from top-tier security without the need to handle extensive PCI DSS controls themselves.

Payment Gateway Integration

HelpYouSponsor integrates with reliable payment gateways to process donations securely and efficiently. Using tokenization, the platform ensures that actual card numbers are never stored on your servers. When a donor contributes, their card details are transmitted directly to the payment processor through secure, hosted payment fields. This method significantly reduces the risk of data breaches.

To further protect organizations, the integration includes fraud prevention tools like Address Verification Systems (AVS) and Card Verification Value (CVV) checks. These features verify donor identities in real-time and flag suspicious activity. Considering nonprofits are 50% more likely to experience cyberattacks than other types of organizations, these measures are crucial for safeguarding donor data and maintaining trust. These protections are part of the automated systems that enhance transparency and donor confidence.

Automated Receipts and Transaction Tracking

Transparency is key to donor trust, and HelpYouSponsor ensures it with automated communication features. Donors receive instant confirmation emails with tax-deductible receipts as soon as their transaction is complete. This not only eliminates delays but also reduces the administrative workload for your team. The platform also integrates with donor management software (CRM), allowing you to track contributions and analyze giving trends in real time. Payment confirmations, invoices, and alerts for failed transactions are handled automatically, keeping donors informed about the status of their contributions.

Built-In Security Standards Compliance

HelpYouSponsor adheres to strict industry security standards, so your organization doesn’t have to manage complex protocols directly. All data transmissions are protected with SSL/TLS encryption (version 1.2 or higher), ensuring donor payment information is encrypted from the moment it’s entered until it reaches the payment processor.

As Stripe explains, "PCI DSS is the global security standard for all entities that store, process, or transmit cardholder or sensitive authentication data".

Steps to Implement Secure Payment Systems

Review Your Current Payment System

Start by completing a PCI Self-Assessment Questionnaire (SAQ) to pinpoint any security weaknesses in your payment process. This evaluation highlights vulnerabilities in how sensitive data, like card numbers, is handled - whether it's during entry, storage, or transmission. Make sure your website uses SSL/TLS encryption (look for "HTTPS" in the browser's address bar) and confirm that your payment processor is PCI Level 1 certified.

Avoid storing full card details unless absolutely necessary. Storing unnecessary data increases your risk, as Chris Teitzel, Founder and CEO of Lockr, wisely points out:

"Hackers cannot steal what you don't have. There is no reason to store thousands of unnecessary records on your customers".

Only collect the data you truly need, and ensure that any physical records - like paper forms - are securely stored or destroyed right after processing. Once you've identified gaps, it's time to implement secure solutions that address these vulnerabilities.

Set Up Secure Solutions with HelpYouSponsor

After reviewing your system, strengthen payment security by integrating solutions like HelpYouSponsor. This platform works with PCI Level 1 certified processors and employs tokenization to keep sensitive data off your servers. By doing so, it reduces both the risk of breaches and the complexity of compliance requirements.

Additionally, enable multi-factor authentication (MFA) for staff who access donor data or payment systems. MFA adds an extra layer of protection, ensuring that even if a password is compromised, unauthorized access is blocked.

With payment fraud targeting 79% of organizations in 2024, HelpYouSponsor also provides automated fraud detection. This feature monitors and blocks suspicious activities, like card testing, in real time. These measures collectively create a safer environment for processing payments.

Communicate Security Measures to Donors

Transparent communication about security builds donor trust. Display visible trust signals, such as the HTTPS lock icon and security badges, to reassure visitors that your site is secure. On your donation form, include a simple statement explaining your safeguards, like: "Your donation is processed through a secure, PCI-compliant gateway".

Bill Sayre from Nonprofit Marketing Guide emphasizes the importance of trust:

"Donor trust – or lack thereof – directly impacts a nonprofit's ability to fundraise successfully".

A concise privacy policy that explains how donor data is used and protected can further reassure donors. You might also offer an option for donors to cover processing fees (usually around 3%), ensuring that 100% of their gift goes to your cause. When presented transparently, about 90% of donors choose to opt in.

Lastly, remember that proper policies, procedures, and training can prevent roughly 90% of data breaches. By being proactive, you can protect sensitive information and maintain donor confidence.

Measuring Success and Maintaining Donor Trust

Track Donor Engagement Metrics

Once you've put strong security measures in place, the next step is to evaluate their impact and ensure they remain effective. Start by monitoring metrics that reflect donor trust. For example, look at donor retention rates and the growth of recurring monthly contributions - these numbers often indicate whether supporters feel confident enough in your platform to stick around. Another useful metric is the percentage of donors willing to cover processing fees, which can signal their trust in your organization’s transparency and efficiency.

Keep an eye on fraud incident rates and chargebacks as well. A secure system should show very few instances of unauthorized transactions or carding attacks. Tools like HelpYouSponsor’s reporting features make it easier to track these trends, giving you the chance to address any weak spots before they become major issues. Considering that the average cost of a data breach is now nearly $9.5 million, catching problems early can save both your funds and your reputation.

| Metric Category | Key Performance Indicator (KPI) | Impact on Donor Trust |

|---|---|---|

| Security | Number of fraud incidents or carding attacks | High: Reduces financial risks and protects donor data. |

| Engagement | Donor retention and recurring gift rate | High: Reflects sustained trust in your platform. |

| Compliance | Timely IRS Form 990 filing | Medium: Shows accountability and adherence to legal standards. |

| Transparency | Accuracy in restricted fund tracking | High: Builds confidence that funds are used appropriately. |

| Efficiency | Time spent on manual receipting | Low/Medium: Enhances donor satisfaction through faster processes. |

Use these indicators to continuously refine your security protocols and improve donor confidence.

Monitor and Update Your Payment Systems

Once you've assessed donor engagement, maintaining trust requires consistent system updates and monitoring. Conduct regular audits to ensure your financial controls and security protocols are functioning as intended. Compare donation records with bank statements on a routine basis to quickly spot any discrepancies or unauthorized transactions. Additionally, review system logs for unusual activity, such as repeated login attempts or access from suspicious IP addresses, which could indicate a potential breach.

Keep your payment software up to date by enabling automatic updates to ensure the latest security patches are applied. Strengthen your defenses further by requiring multi-factor authentication for staff who handle donor data and periodically reviewing user permissions to limit access to sensitive information.

Summary of Best Practices

To maintain donor trust, focus on three key areas: enforce strong security measures, communicate openly about those protections, and continuously monitor your systems. Solutions like HelpYouSponsor, which incorporate tokenization and fraud detection, can help reinforce your efforts. Displaying trust signals on your donation forms is another way to reassure donors that their information is safe.

With 92% of donors prioritizing data protection and most breaches being preventable, taking these steps will not only safeguard donor information but also encourage consistent and confident giving. Tracking the right metrics and keeping your systems updated creates a solid foundation for long-term trust and support.

FAQs

What can nonprofits do to ensure donor information stays secure?

Nonprofits can safeguard donor data by adopting secure payment systems and robust data management practices. Start with a PCI-DSS-compliant payment gateway that encrypts payment details during transactions and substitutes sensitive information with secure tokens. To prevent fraud, activate tools like Card Security Code (CSC) checks, Address Verification System (AVS), and CAPTCHA to deter unauthorized activities.

When collecting personally identifiable information (PII), only gather what’s absolutely necessary, and make sure any stored data is encrypted. Access to donor records should be tightly controlled using role-based permissions, unique user credentials, and multi-factor authentication. Regular software updates, security audits, and timely patching of vulnerabilities are critical for maintaining a secure environment.

Equally important is staff training. Teach your team to spot phishing attempts, create strong passwords, and follow established incident-response protocols. Having a well-defined plan for managing data breaches not only helps comply with regulations but also reinforces donor trust.

What impact do data breaches have on donor trust and nonprofit operations?

Data breaches can wreak havoc on a nonprofit’s relationship with its donors and tarnish its reputation. When sensitive personal or financial information is exposed, donors may lose confidence in the organization’s ability to protect their data. This loss of trust can lead to fewer contributions and make it harder to attract new supporters. Since trust is the backbone of successful fundraising, a breach can severely damage that foundation.

The financial toll of a data breach goes beyond lost donations. Nonprofits often face expensive operational challenges, such as conducting forensic investigations, notifying affected donors, and upgrading security systems. These efforts divert funds away from the organization’s mission. On top of that, fines for regulatory violations and charge-back fees can add even more strain to already tight budgets.

Operational disruptions are another harsh reality. Donation processing might need to be paused, manual systems could temporarily replace automated ones, and outreach efforts may be delayed while security vulnerabilities are addressed. These setbacks not only slow down fundraising efforts but can also interfere with the nonprofit’s ability to provide critical services, putting its mission at risk.

Why is PCI DSS compliance crucial for nonprofit payment systems?

For nonprofit organizations, keeping donors' payment information secure is non-negotiable. That’s where PCI DSS (Payment Card Industry Data Security Standard) compliance comes into play. By following these standards, nonprofits can ensure sensitive payment data is handled safely, reducing the chances of fraud and data breaches.

Using secure payment systems that align with PCI DSS requirements does more than just protect transactions - it shows donors that their trust is valued. This level of accountability and transparency is crucial for maintaining donor confidence, which, in turn, encourages ongoing support for the organization’s mission.