How Mobile Payments Support Global Sponsorship Programs

Mobile wallets, P2P apps and payment gateways boost accessibility, transparency, and efficiency for cross-border sponsorships and recurring nonprofit donations.

Mobile payments are transforming how nonprofits deliver funds in global sponsorship programs. Here's why they matter:

- Accessibility: Mobile wallets and apps reach areas where traditional banking fails, such as rural regions or crisis zones. For instance, in Haiti, 85% of the population had mobile phones in 2010, but banking services were scarce.

- Efficiency: Tools like mobile wallets and peer-to-peer payment apps ensure fast, secure, and transparent fund transfers, bypassing delays seen in traditional systems.

- Transparency: Real-time tracking and automated reporting build trust with donors, ensuring every dollar is accounted for.

- Cross-border ease: Mobile payment gateways simplify international donations by automating currency conversions and reducing fees compared to traditional methods.

These technologies make it easier for donors to contribute and for nonprofits to manage funds effectively, ensuring aid reaches those who need it most.

Mobile Payment Impact on Global Nonprofit Donations: Key Statistics

How Mobile Wallets Make Donations More Accessible

Making Donations Easier with Mobile Wallets

Mobile wallets have simplified the way people donate to causes they care about. Apps like Apple Pay, Google Pay, and Samsung Pay allow users to add their card details just once. From there, donating is as easy as holding a smartphone near a contactless terminal or selecting the wallet option during checkout on a mobile website. Built-in security features like biometric authentication and tokenization ensure that donor data stays safe, shielding sensitive financial details from being directly shared with the charity. This not only reduces the risk of fraud but also ensures that donations reach their intended recipients without compromising personal banking information.

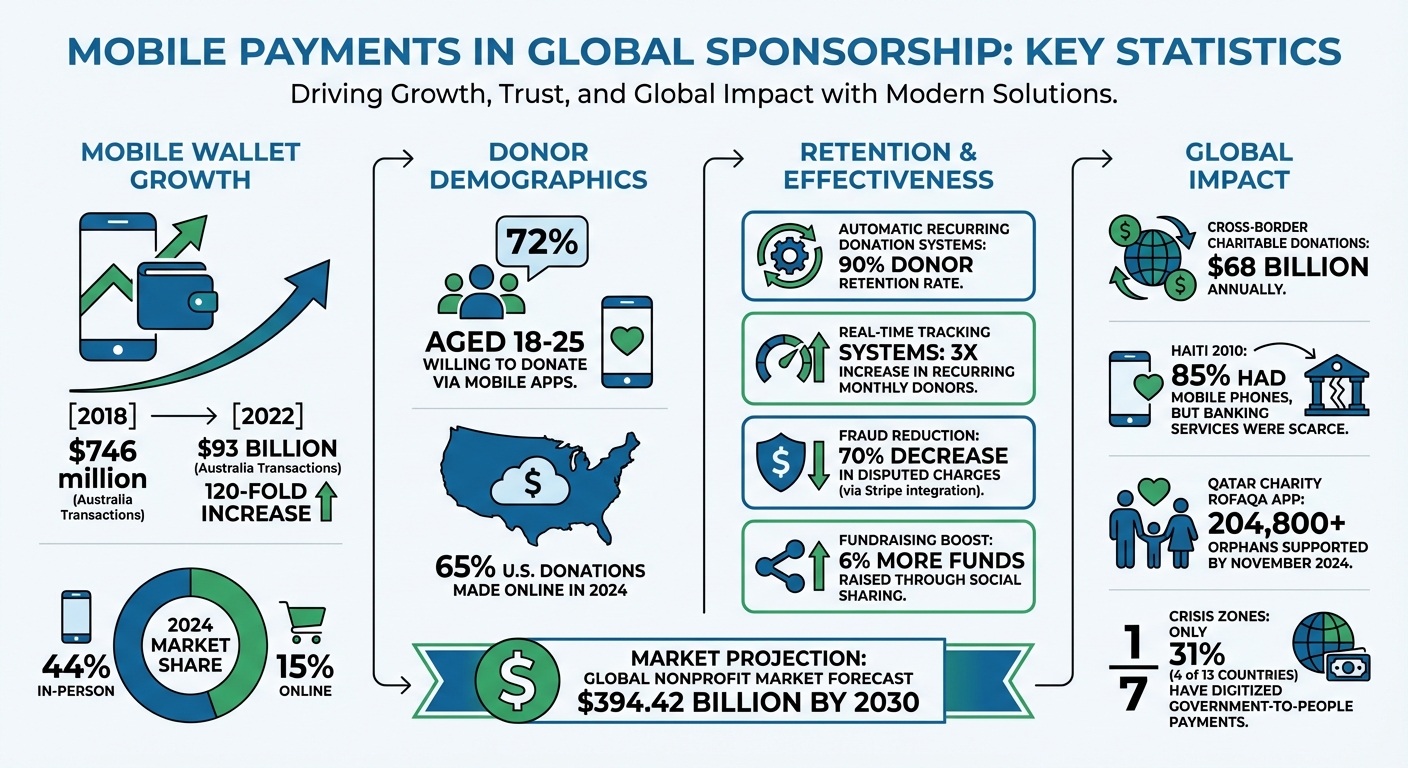

The rise of mobile wallets has been nothing short of impressive. In Australia, for example, transactions made using mobile wallets skyrocketed from $746 million in 2018 to over $93 billion in 2022 - a staggering 120-fold increase in just four years. By 2024, these wallets accounted for 44% of all in-person transactions and 15% of online payments in the country. Younger donors are particularly driving this trend, with 72% of individuals aged 18 to 25 expressing a willingness to donate through mobile apps if given the option.

The convenience and security of mobile wallets have also proven invaluable in urgent situations, like crisis relief efforts in Haiti.

Case Study: Mobile Wallets in Child Sponsorship Programs

Haiti's response to the 2010 earthquake offers a powerful example of how mobile wallets can transform aid distribution. The disaster overwhelmed traditional banking systems, leaving more than half of donor funds bottlenecked and unable to reach those in need.

To address this, the Bill & Melinda Gates Foundation and USAID launched the Haiti Mobile Money Initiative in January 2012, backed by a $10 million incentive fund. Partnering with telecom providers Digicel and Voila, they bypassed damaged banking infrastructure by delivering cash transfers directly to mobile phones. This effort laid the groundwork for the Government of Haiti's "Ti Manman Cheri" (TMC) program, introduced in May 2012. Funded with $15 million from the PetroCaribe fund, TMC was the country's first conditional cash transfer program, using mobile money to send funds directly to mothers. This initiative showcased how mobile wallets could quickly and securely reach vulnerable populations, achieving what traditional systems could not.

Using Peer-to-Peer Payment Apps for Recurring Donations

Setting Up Monthly Donations

Peer-to-peer payment apps make it incredibly easy for donors to commit to ongoing support. With just a few taps, donors can choose how often they want to give - whether it’s weekly, monthly, quarterly, or annually. Payments can be made through a variety of methods, including credit cards, debit cards, PayPal, Apple Pay, or Google Pay. Apps like REACH even let donors explore sponsorship opportunities and set up recurring donations directly from their smartphones. Plus, managing these recurring contributions is simple, thanks to dedicated sections within the app.

Here’s an interesting stat: automatic recurring donation systems retain 90% of their donors. These apps not only streamline the donation process but also help build stronger, long-term connections with supporters.

Connecting with Donors Through Payment Messages

Another standout feature of peer-to-peer apps is their ability to facilitate personal connections. Many platforms include a messaging or "thoughts" feature, allowing donors to attach messages or images to their contributions. This adds a personal touch, helping donors feel more engaged and connected to the causes they care about. For example, users of JustGiving are estimated to raise 6% more funds by sharing updates and stories on their fundraising pages.

These small, thoughtful interactions can go a long way in fostering donor loyalty and encouraging continued support.

Improving Transparency with Mobile Payment Integrations

Real-Time Donation Tracking

Mobile payment platforms make it possible to track donations instantly, giving donors immediate confirmation of their contributions. This not only builds trust but also leads to an impressive 3X increase in recurring monthly donors. These platforms centralize all payment methods - whether it's digital wallets, direct debits, or credit cards - into a single, easy-to-use dashboard, simplifying the process for nonprofits to monitor funds. During high-traffic events like Giving Tuesday, these systems can handle hundreds of transactions per second.

Security is a top priority, with tools like Stripe Radar providing real-time fraud protection. A key example is Fundraise Up's partnership with Stripe starting in 2018, which enhanced donor checkout experiences globally. This integration doubled online donation revenue and reduced disputed charges by 70%. These streamlined and secure processes feed directly into detailed financial reporting, ensuring every dollar is tracked and accounted for.

Creating Detailed Financial Reports

Mobile integrations take the hassle out of financial reporting by automating data capture. These tools eliminate manual entry errors and sync seamlessly with CRM software. Each transaction is automatically linked to donor profiles, making it easier to generate reports that clearly show how funds are being allocated.

HelpYouSponsor's dashboards take this a step further by consolidating donation trends, enabling nonprofits to refine their fundraising strategies. The system also generates digital receipts for tax purposes and ensures secure data storage. This level of reporting is invaluable when breaking down contributions for sponsors - for instance, showing that 80 cents of every dollar goes directly to fieldwork or explaining administrative costs that sustain operations.

"Financial transparency isn't just a regulatory hoop to jump through - it is the foundation of a sustainable, impactful organization." - Children of the Mekong

A great example of accountability in action is Qatar Charity's Rofaqa app, launched in 2014. This platform allows sponsors to set up monthly donations and track the progress of children in real time. Sponsors also receive periodic reports, ensuring transparency and accountability. By November 2024, the initiative had supported over 204,800 orphans. This approach turns one-time donations into long-term commitments, fostering deeper connections between donors and their causes.

Handling International Payments with Mobile Payment Gateways

Processing Cross-Border Donations

Mobile payment gateways have made it easier for nonprofits to handle international donations by automatically converting currencies. For instance, if someone in the UK donates to a nonprofit in the U.S., the gateway takes care of converting British pounds into U.S. dollars using the current exchange rate - no manual steps required. This convenience is crucial, especially considering that global cross-border charitable donations now exceed $68 billion annually.

Some platforms even allow donors to use their local banks directly. With this setup, donors can select their bank for the transfer, and the gateway handles the currency conversion and sends the funds straight to the nonprofit's account. This approach often gives nonprofits more flexibility in managing foreign exchange (FX) costs compared to traditional credit card networks, where exchange rates are typically fixed.

However, transaction fees can take a bite out of donations. For example, a £1,000 contribution might incur a £40 fee - about 4%. Donations made via credit cards can face even more deductions due to processing fees, foreign transaction charges, and global acquirer fees, which may reduce the net donation by 1% to 3%. To counter this, some payment providers work directly with local banks, cutting out middlemen and offering a more transparent process.

"Traditional banks are often built around legacy systems that prioritize volume over service. For NGOs working in conflict zones... this approach creates barriers instead of solutions."

– Inpay

The payment preferences of donors also vary widely by region. In India, while 80% of the population has a bank account, only 21% use credit or debit cards. Similarly, in Thailand, 82% are banked, but just 10% rely on cards. This highlights the importance of supporting local payment methods like UPI in India or PromptPay in Thailand. By integrating with multiple payment gateways, platforms like HelpYouSponsor enable nonprofits to accept donations through the channels donors are most comfortable using.

These streamlined systems also help nonprofits navigate the complexities of international financial regulations.

Meeting International Financial Regulations

For nonprofits, complying with international financial regulations can be a major hurdle. Banks often view NGO payments as high-risk due to stringent requirements tied to sanctions, anti-money laundering (AML), and counter-terror financing (CTF). This classification can lead to restricted transactions and higher administrative costs for nonprofits.

Modern payment gateways help by automating compliance tasks. Instead of manually tracking regulatory requirements across multiple countries, these platforms simplify the process, reducing the workload for finance and program staff. This automation complements advancements like mobile-wallet security and real-time tracking, which help build donor confidence.

"E-payment mechanisms, including mobile-based money transfers and card-based payments such as prepaid debit cards, are effective tools that enable efficient and scalable transfers, improve transparency, and mitigate fraud in humanitarian response."

– International Rescue Committee

The challenges become even more pronounced in crisis zones. Out of 13 countries facing severe humanitarian crises, only 4 (31%) have digitized Government-to-People payment programs. Specialist payment providers step in here, using networks that span over 200 countries to help nonprofits navigate complex compliance landscapes in high-risk or underserved areas. Their expertise in local banking systems allows them to process payments even where traditional banks cannot operate.

Transparency is key when it comes to meeting regulatory requirements. Payment gateways that offer real-time tracking document every transaction, making audits and financial reviews much smoother. For instance, HelpYouSponsor’s dashboard consolidates all transaction data in one place, giving nonprofits the tools they need to stay compliant and maintain donor trust.

4 Essential Mobile Fundraising Strategies for Nonprofits

Conclusion

Mobile payment technologies have reshaped the way global sponsorship programs operate, making it easier than ever for donors to contribute. Features like one-tap wallets, automated recurring payments, and real-time tracking have streamlined the process, allowing individuals from around the world to support causes effortlessly. In fact, nearly 65% of U.S. donations were made online in 2024, and projections show the global nonprofit market reaching $394.42 billion by 2030. These advancements ensure child sponsorship programs receive consistent and secure funding.

But this shift to digital payments goes beyond mere convenience. It enhances trust through robust security measures, reduces costs with lower transaction fees, and promotes accountability with transparent audit trails. With tools like mobile wallets and cross-border payment gateways, donors and nonprofits alike benefit from a more efficient and reliable system for managing contributions.

For child sponsorship programs, these technologies are game-changers. Automated billing ensures monthly donations continue without interruption, while smart retry mechanisms recover failed payments with minimal effort. This steady stream of funding is crucial for sustaining long-term commitments and supporting the children and communities that rely on these programs.

The most impactful sponsorship programs are those that fully embrace these digital tools, creating a smooth and transparent experience for donors. By doing so, nonprofits can focus on what truly matters - making a lasting difference in the lives of children and their communities.

FAQs

How do mobile payments increase transparency in nonprofit donations?

Mobile payments bring a new level of clarity by offering instant confirmations and receipts, reassuring donors that their contributions have been successfully received and processed. This quick feedback helps establish trust in the nonprofit’s financial operations.

What’s more, mobile payment systems simplify the process of tracking and documenting transactions. This transparency makes it easier for nonprofits to update donors on how their funds are being used, reinforcing accountability and minimizing the potential for misuse. By using these tools, nonprofits show they’re dedicated to responsible financial practices, which can inspire continued donor confidence and support.

How do mobile wallets make donating easier and more accessible?

Mobile wallets have transformed the way people donate, offering a quick, secure, and hassle-free way to contribute directly from their smartphones. No need to carry cash or dig out a credit card - features like QR codes and contactless payments make giving as easy as a few taps. This simplicity often leads to more frequent and even spur-of-the-moment donations.

Security is another major perk. With encryption and authentication built in, mobile wallets ensure transactions are protected. They also make recurring donations a breeze, allowing donors to set up ongoing contributions without repeatedly entering payment details. This streamlined process not only broadens the reach to supporters, including those in remote areas, but also strengthens donor engagement and helps sustain global sponsorship efforts.

How do mobile payment systems simplify international donations and currency exchange?

Mobile payment systems simplify international donations by handling multiple currencies effortlessly. They allow donors to give in their local currency while ensuring recipients receive the funds in the correct format. This eliminates the hassle of manual currency conversions or relying on separate exchange services.

These platforms also focus on clarity and efficiency by integrating different payment methods, making cross-border transactions smoother, and following international compliance rules. This setup removes obstacles for donors and guarantees prompt, accurate transfers to back global sponsorship initiatives.