Using Mobile Payments to Increase Donor Contributions for Nonprofits

Mobile wallets and one‑tap payments make donating easier, increasing average, unplanned, and recurring gifts while improving donor retention.

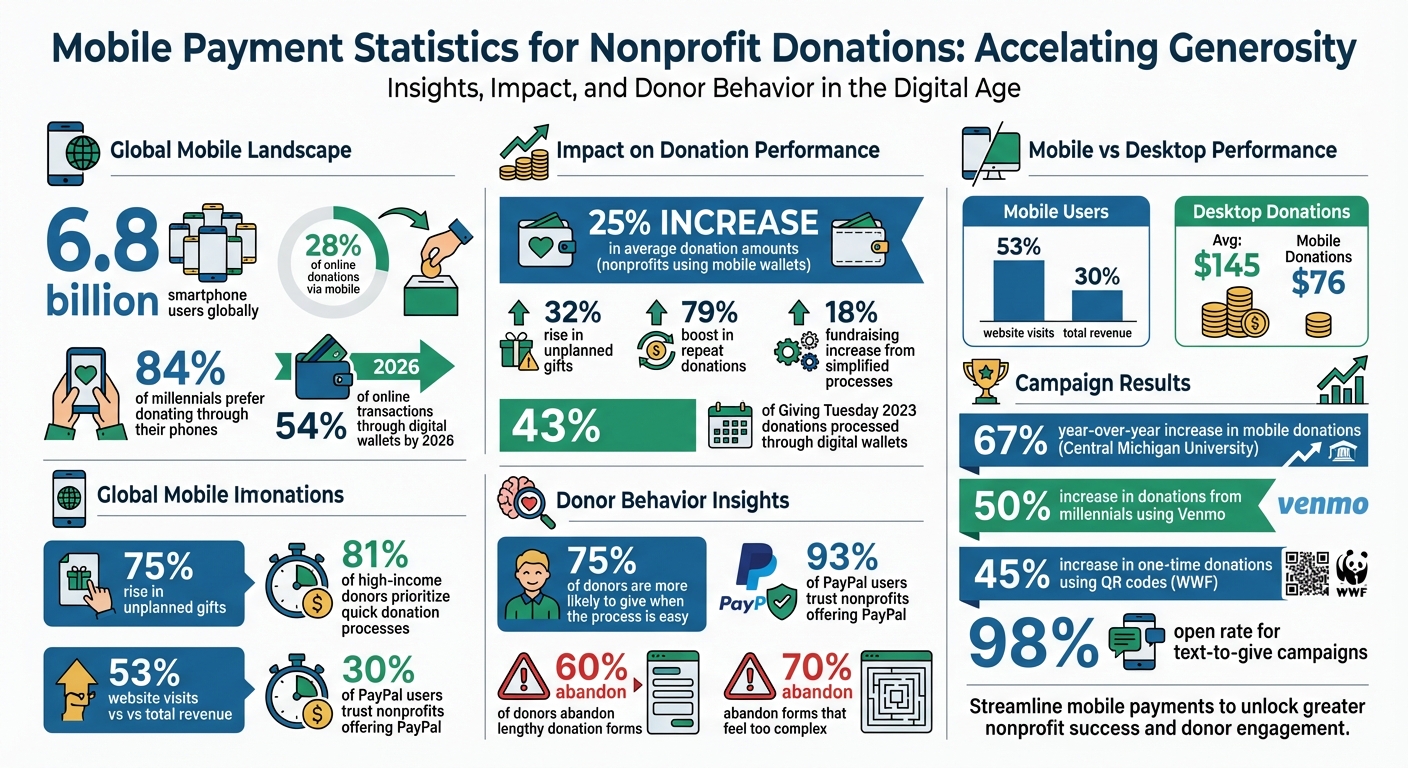

Mobile payments are transforming how nonprofits receive donations. With 6.8 billion smartphone users globally, donors now prefer giving directly from their devices. Here's why mobile payment systems like Apple Pay, Google Pay, PayPal, and Venmo are game-changers for nonprofits:

- 28% of online donations happen via mobile devices, and 84% of millennials prefer donating through their phones.

- Nonprofits using mobile wallets report a 25% increase in average donation amounts, a 32% rise in unplanned gifts, and a 79% boost in repeat donations.

- Speed matters: Simplified donation processes, like "Express Donate", have led to fundraising increases of up to 18% by adopting modern fundraising strategies.

- Features like recurring payments and social-sharing tools strengthen donor engagement and loyalty.

The shift to mobile payments isn’t optional anymore - it’s a must for nonprofits aiming to meet donors where they are. Simplify your donation process, integrate mobile wallets, and leverage tools like HelpYouSponsor for seamless payment experiences. Nonprofits that embrace mobile giving are already seeing results, with 43% of Giving Tuesday 2023 donations processed through digital wallets.

Mobile Donation Statistics and Impact for Nonprofits

Benefits of Mobile Payments for Nonprofit Donations

More Convenient for Donors

Mobile wallets make donating simpler by removing the need to manually input credit card details. In fact, 75% of donors are more likely to give when the process is easy. Tools like Apple Pay, Google Pay, PayPal, and Venmo offer one-tap donations with biometric verification, making the process seamless and secure.

This simplicity plays a big role in contextual giving - when donors contribute right at the moment they feel inspired, whether it’s from a social media post, a live event, or scanning a QR code on a flyer. For instance, 81% of high-income donors prioritize a quick and straightforward donation process. By reducing friction, nonprofits can lower donor drop-off rates. As Qgiv highlights:

"The greatest strength of mobile giving is that it encourages contextual giving. Contextual giving shrinks donation abandonment rates by keeping donors in the same context that inspired them to give in the first place." – Qgiv

The results speak for themselves. During Giving Tuesday 2023, some nonprofits reported that 43% of donations were made using digital wallets. This level of convenience not only speeds up transactions but also builds donor confidence.

Faster Transaction Processing

Convenience aside, speed plays a critical role in capturing donor enthusiasm before it fades. For example, in October 2024, Children's Miracle Network Hospitals teamed up with DonorDrive and PayPal to introduce "Express Donate", cutting their donation process time in half. This upgrade led to an 18% increase in funds raised, allowing virtual event attendees to complete transactions more quickly and easily.

Speed matters. Studies show that even a one-second delay in loading or processing can reduce donation conversions by 7%, while 70% of users will abandon a donation form if it feels overly complex. Mobile giving apps simplify this process, often allowing donations to be completed in just three taps. By enabling immediate contributions, nonprofits can better capture impulse donations in real time.

Better Donor Engagement and Retention

Mobile payments don’t just streamline one-time donations - they also strengthen long-term donor retention. Features like automated recurring giving and easy-to-use donor portals help retention rates climb above 80%, while also boosting recurring contributions.

Nonprofits integrating PayPal into their donation forms have reported a 32% increase in total donations and a 79% rise in recurring gifts. Meanwhile, Venmo’s social-sharing features have driven a 50% increase in donations from millennials. Trust also plays a role - 93% of PayPal users say they trust nonprofits offering PayPal as a payment option.

The impact is clear. When Central Michigan University added digital wallet support to its Giving Day campaign in 2022, mobile donations surged by 67% year-over-year. These streamlined systems not only secure immediate gifts but also nurture the kind of donor trust and loyalty that nonprofits rely on for sustained success.

Office Hours: How to Add Google Pay and Apple Pay to your Donation Page

How to Integrate Mobile Payment Platforms with HelpYouSponsor

HelpYouSponsor makes it simple to integrate mobile payment platforms, helping you maximize donor contributions. The platform supports two payment gateways simultaneously - PayPal and one credit card processor (such as Stripe, Flutterwave, QPayPro, or Authorize.net). To get started, head to the Settings menu in your HelpYouSponsor dashboard and select Payment Gateways. Before activating any gateway, double-check that your HelpYouSponsor Base Currency matches the currencies supported by your chosen payment processor.

Setting Up PayPal for Donations

Integrating PayPal with HelpYouSponsor adds instant mobile optimization to your donation forms. Donors can contribute using their PayPal account or as guests with credit or debit cards. If your organization is a registered 501(c)(3), confirm your charity status with PayPal to unlock discounted processing rates. PayPal charges no setup or monthly fees, and transaction fees are only applied when donations are processed. Funds typically transfer to your PayPal account within minutes, though bank transfers usually take 2–3 business days.

For mobile-focused campaigns, create a custom PayPal.Me link to share via social media or text messaging. You can also enable recurring donation options, allowing donors to set up automatic monthly contributions that they can manage themselves. All PayPal donation tools are mobile-friendly by default, ensuring a seamless experience on smartphones and tablets.

Using Stripe for More Donor Payment Options

Stripe acts as your credit card gateway within HelpYouSponsor, supporting all major credit and debit cards. It also enables digital wallet payments through Apple Pay and Google Pay, making it easier for mobile donors to contribute. Stripe supports both one-time and recurring donations, and donors can manage their subscriptions, update payment details, or adjust donation amounts via Stripe's customer portal. With PCI Level 1 certification - the highest in the payments industry - Stripe ensures every transaction is encrypted and secure.

Stripe has no setup or monthly fees, and you only pay per transaction. Nonprofits can apply for discounted rates to keep more of their donations. For larger or recurring gifts, consider promoting ACH bank transfers through Stripe, as they typically have lower transaction costs compared to credit cards. You can also activate Stripe Radar in your dashboard for real-time fraud detection and prevention. Additionally, you can enable Venmo for US donors through your existing PayPal integration.

Activating Venmo via PayPal for US Donors

Venmo works seamlessly through your PayPal gateway on HelpYouSponsor. Once your PayPal Business account is linked, Venmo automatically becomes available as a payment option for eligible US-based donors during checkout. This is a valuable feature, considering Venmo's popularity among over 70 million users, including about 7.4 million aged 18–34.

To ensure Venmo appears for donors, make sure your PayPal integration uses the modern PayPal Checkout rather than the older PayPal Classic. Venmo is accessible through supported mobile browsers like Safari on iOS or Chrome on Android and even works when donors scan a QR code on a desktop.

"Digital wallets like Venmo are here to stay and rule the market. They're not just popular among the younger generations but also slowly making their way to the baby boomers." – Zarq, Product Manager – Integrations, Donorbox

If you're a registered 501(c)(3) nonprofit, Venmo transactions through PayPal typically cost 1.99% + $0.49 each, with no extra setup fees. While Venmo generally supports one-time donations rather than recurring ones, its social-sharing feature allows donors to share their contributions with their Venmo friends feed, offering an added layer of organic visibility.

Best Practices for Mobile Payment Campaigns

Simplifying the Donation Process

Keep your donation forms short and simple - long forms lead to higher donor abandonment rates. In fact, 60% of donors leave lengthy pages, and 22% drop off due to complicated checkouts. To avoid this, limit your forms to five fields or less. Research shows that up to 70% of donors abandon forms that feel too complex.

Make donating easier with one-tap payment options like Apple Pay, Google Pay, and Venmo. These methods eliminate the need for manual card entry and can increase the average donation amount by 25%. A streamlined, mobile-first approach is essential for creating a smooth donation experience.

Design your forms with mobile users in mind. Use a single-column layout, large buttons that are easy to tap, and ensure the page loads in under three seconds. Offering 4–6 suggested donation amounts helps donors decide faster, and adding a simple checkbox for recurring donations can increase annual donor contributions by 42%.

Promoting Mobile Payment Options to Donors

Once your donation process is optimized, the next step is to promote these mobile payment options effectively. Since 54% of nonprofit emails are opened on mobile devices, tailor your email campaigns for small screens. Use at least 14-pixel font for readability, and place your "Donate Now" button prominently - often on the left side for easy access. Keep subject lines under 30 characters so they display fully on mobile screens.

QR codes are another great tool for connecting offline and online giving. For example, the World Wildlife Fund saw a 45% increase in one-time donations during a campaign by adding QR codes to their print materials, directing donors to a mobile-friendly donation page. QR codes can be included on direct mail, event signs, billboards, or even volunteer apparel.

Text-to-give campaigns also drive results. Text messages boast a 98% open rate and generate an average of $92 for every 1,000 messages sent. A notable example: Doctors Without Borders experienced a 50% increase in emergency funds during live broadcasts by using text-to-donate campaigns. Keep your keywords simple and memorable so donors can easily give right from their texting app.

Building Security and Trust in Transactions

While convenience encourages donations, visible security features build trust. Adding trust badges and recognizable logos can reassure donors - studies show people feel more confident using digital payment options when security is emphasized.

Choose a payment processor that meets PCI Level 1 compliance, the highest industry standard for security. Features like tokenization and encryption protect sensitive card data during transactions. With over 80% of Americans using digital payments, donors expect bank-level security.

"If your donation form is clunky, confusing, or feels even slightly unsafe, that gift might never come through." – Stripe

Send immediate confirmation emails with tax receipts after every transaction to reassure donors that their payment was successful. Consistent branding throughout the donation process also helps prevent confusion caused by third-party services. Combining these security measures with mobile payment options ensures a seamless and trustworthy donor experience.

Measuring and Improving Mobile Donation Performance

Tracking Key Metrics for Mobile Donations

To truly understand your mobile donation performance, start by monitoring key metrics like your conversion rate - the percentage of mobile visitors who complete a donation - and the average donation amount by device type. Here’s an eye-opening stat: while mobile users account for 53% of nonprofit website visits, they only contribute 30% of total revenue. Desktop donations average $145, but mobile gifts lag behind at $76.

Another crucial metric is your drop-off rate, which reveals where potential donors abandon the process. With up to 70% of visitors not completing their online donations, pinpointing these drop-off points can help you optimize the donor journey.

Don’t overlook your recurring gift percentage, either. Monthly donors contribute 42% more annually than one-time givers. Additionally, track which channels - whether SMS, QR codes, email, or social media - drive the most mobile traffic and revenue. These metrics provide a solid foundation for deeper analysis, especially when paired with HelpYouSponsor’s reporting tools.

Using HelpYouSponsor's Reporting Features

HelpYouSponsor takes these metrics further by offering real-time reporting tools that allow you to fine-tune your strategy. The platform tracks every donation and commitment, enabling you to compare performance across payment methods and campaigns. By exporting this data, you can uncover trends based on month, event type, or donor segment. For instance, you might identify peak giving times or discover which mobile payment options resonate most with your donors.

What’s more, HelpYouSponsor allows you to segment donors by demographics, location, or past giving amounts. This segmentation enables you to craft personalized follow-up campaigns. Since recurring donors have a lifetime value nine times higher than one-time donors, tracking which mobile donors transition to monthly giving can significantly impact your long-term revenue. The platform also streamlines post-donation communication with automated receipts and messaging, keeping donors engaged after they give.

Continuous Improvement Through Data Analysis

With the insights from your metrics and reporting, you can continuously refine your mobile donation approach. Start by testing one element at a time - such as button placement or suggested donation amounts - and pay close attention to page load speeds, as slow pages can drive abandonment. For example, if your data shows an average mobile gift of $42, try setting suggested donation amounts to $50 in your next campaign to encourage slightly higher contributions.

"When we look at data from nonprofits that are open to new technologies and adopting innovations, we see that they're able to achieve results that defy the industry results as a whole." – Salvatore Salpietro, Chief Community Officer, Fundraise Up

Eliminating friction in your donation forms is another game-changer. With 72% of millennials preferring platforms like PayPal or Venmo for donations, tracking and promoting digital wallet adoption can significantly boost conversions. Regular data analysis ensures that you’re not just collecting insights but actively transforming them into actionable strategies to improve your mobile donation performance over time.

Conclusion

Mobile payments have become a crucial part of nonprofit fundraising, especially for organizations aiming to stay relevant in an increasingly digital world. With projections showing that 54% of online transactions will be made through digital wallets by 2026, nonprofits that fail to offer mobile-friendly donation options risk losing valuable contributions before donors even complete their gifts. In fact, integrating mobile wallets like PayPal and Venmo has been shown to boost average donation amounts by 25%.

To make the most of this shift, focus on simplifying your donation process. Keep forms short - no more than five fields - ensure your pages load in under three seconds, and provide multiple payment options. These steps are critical since 81% of high-income donors value a fast donation process, and 60% abandon donations due to overly complicated checkouts. Reducing unnecessary steps and clicks can make a huge difference in capturing donations.

HelpYouSponsor offers a straightforward way to integrate mobile payment platforms like Stripe, PayPal, and Venmo into your donor management system. This not only enables real-time syncing and automated receipts but also provides detailed reporting tools to help your organization continuously improve. Adopting such solutions now ensures you’re prepared to meet donors’ expectations.

The impact of mobile giving is already evident. For example, 93% of PayPal users report greater trust in nonprofits that offer familiar payment options, and 43% of Giving Tuesday 2023 donations were processed through digital wallets. The question isn't whether to implement mobile payments - it’s how quickly you can optimize them to better serve both your mission and your donors.

FAQs

How can mobile payments help nonprofits increase donations?

Mobile payments make giving quicker, simpler, and more convenient, inspiring people to donate more frequently and generously. Since smartphones are a constant presence in our lives, supporters can contribute anytime, anywhere - no need to wrestle with long forms or repeatedly input payment details.

Nonprofits can make the process even smoother by offering tools like digital wallets, text-to-give, and mobile-friendly donation forms. These options simplify the experience, making it secure and hassle-free for donors. This ease of use not only encourages more engagement but also often leads to larger contributions, as the process feels straightforward and natural.

What are the advantages of using mobile wallets for nonprofit donations?

Using mobile wallets for nonprofit donations brings several standout benefits. They simplify the process by offering familiar payment methods like Apple Pay, Google Pay, Venmo, and PayPal, making donations quicker and more convenient. This ease of use can inspire spontaneous generosity and remove hurdles that might otherwise discourage giving.

With the world increasingly embracing digital payments, mobile wallets have become a must-have for modern fundraising efforts. They provide secure and flexible options, improving the donor experience and appealing especially to younger, tech-savvy individuals. By integrating mobile wallets into their donation systems, nonprofits can make giving seamless and potentially see an increase in contributions.

How can nonprofits effectively use mobile payment platforms to boost donations?

Nonprofits can encourage more donations by offering a smooth and mobile-friendly donation experience. Start by making sure your website works seamlessly on mobile devices. This means using a clean, uncluttered design, limiting the need for excessive scrolling, and placing clear "Donate" buttons in easy-to-spot locations. Also, aim for pages that load quickly - ideally in under three seconds - and provide easy-to-complete mobile donation forms to prevent donor frustration.

Adding digital wallet options like Apple Pay, Google Pay, and PayPal can make donating faster and more convenient across different devices. Reliable payment gateways allow nonprofits to offer varied donation options, including one-time and recurring contributions, which cater to different donor preferences. Features like large, easy-to-tap buttons and simplified forms can further improve the experience. By focusing on accessibility and ease of use, nonprofits can make mobile giving a hassle-free process for supporters.